The Argument Against Income Inequality

The Argument Against Income Inequality

Imagine four families sharing a large, jointly owned backyard area. The families would like to install a swing set, slide, etc. for their children to share. The set costs $1,200, and they need to figure out how to pay for it. One of the households is fairly well off and would be willing to pay up to $800 for the swing set. But the other three families struggle to make ends meet, and each is only willing to pay $250. These families really want the swing set – even more than the well-to-do family – but even $250 is a squeeze on their tight budgets.

If everyone is asked to contribute equally to the swing set, $300 each, it won’t get purchased since that is more than the poorer households are willing to pay. But there are arrangements that will work. Suppose, for example, that the wealthy family offers to put up half, $600, leaving the other three families to share the remaining $600, or $200 each. The wealthy family gets a swing set for $600 even though it would have been willing to pay up to $800 for it – economists say this family enjoys $200 in consumer surplus. The less wealthy families also receive $50 in consumer surplus since each household gets the playground equipment for only $200 even though it would have paid $250.

Thus, if we insist upon equal contributions from everyone, we forego the opportunity to make all of the families better off – to give each family goods and services for a price less than their full willingness to pay. In economic terms, allowing unequal contributions increases efficiency. [Read here]

The Argument For Income Inequality

The Argument For Income Inequality

“Tearing down the rich does not help those less well- off,” said the chairman of New York-based WL Ross & Co. LLC. “If you favor employment, you need employers whose businesses are flourishing.”

That view is shared by Robert Rosenkranz, CEO of Wilmington, Delaware-based Delphi Financial Group Inc., a seller of workers’-compensation and group-life insurance.

“It’s simply a fact that pretty much all the private- sector jobs in America are created by the decisions of ‘the 1 percent’ to hire and invest,” Rosenkranz, 69, said in an e- mail. “Since their confidence in the future more than any other factor will drive those decisions, it makes little sense to undermine their confidence by vilifying them.” [Read here]

The Monsieur’s Brief: Either way you cut it, the rich don’t consume much more than the middle class or the poor. Assume you’re in the 1% and you spend $200 on your steak versus $40 steak that 5 middle income men might consume each in a week. You’re NOT eating 5 steaks and there are significantly bigger numbers of the middle class (for now); You’re not really spending that much more to keep the economy going; Impoverish them and you run the risk of creating a new underclass of poor and ultra-poor.

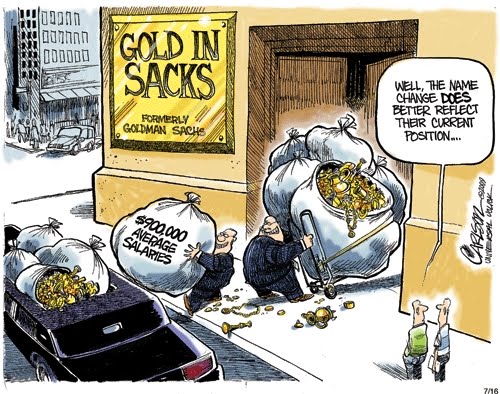

As for the wealthy creating more jobs- how much of that wealth is created through private enterprise (making things) and how much via financial services? For every Steve Jobs (who by the way outsources his production to cheap labour in China), there are 10 bankers who take risks and hedge bets via short selling on both sides of the financial equation. You decide on what works.

Posted on December 22, 2011

0